How I Ride the Investment Cycle in Experience Spending

What if your weekend getaway or concert ticket wasn’t just a cost—but part of a smarter financial strategy? As someone who’s navigated market highs and lows, I’ve learned that experience consumption isn’t just about joy—it can align with the investment cycle. It’s not spending blindly; it’s spending with purpose. Let me show how treating experiences as value-driven choices can reshape your financial mindset—without promising unrealistic returns. When planned wisely, what feels like indulgence can become a reflection of financial awareness, a signal of economic timing, and even a tool for long-term stability. The line between spending and strategy is thinner than many realize.

The Shift: From Stuff to Experiences

In the past, financial success was often measured by visible ownership—luxury cars, designer clothes, large homes. These were the markers of achievement, the symbols people used to signal prosperity. But over the last two decades, a quiet but powerful shift has taken place in how people define value. Today, more individuals, particularly those in their 30s to 50s, are choosing to spend on moments rather than material goods. A weekend yoga retreat, a family trip to a national park, or tickets to a live theater performance are increasingly seen not as luxuries, but as meaningful investments in well-being.

This change is not merely cultural—it reflects deeper economic and psychological trends. Research from institutions like Cornell University has shown that people derive longer-lasting happiness from experiences than from possessions. The joy of a new handbag fades; the memory of a sunrise over the Grand Canyon does not. Experiences become stories, shared with others, revisited in conversation, and woven into personal identity. This emotional durability makes them feel more valuable, even if they don’t appear on a balance sheet.

From a financial perspective, this shift matters. When households redirect discretionary income toward experiences, it changes spending patterns in ways that ripple through the economy. Service sectors—travel, hospitality, entertainment—grow in importance. Consumer behavior becomes more sensitive to time, convenience, and emotional payoff rather than brand logos or product features. For the individual, this means redefining what counts as a “wise” use of money. A vacation is no longer just an expense; it can be a deliberate choice that supports mental health, strengthens family bonds, and even improves productivity upon return.

Understanding this evolution is the first step in aligning personal finance with modern values. It allows individuals to move beyond guilt-driven budgeting—where fun is seen as wasteful—and toward a more balanced approach. When you recognize that experiences contribute to overall life satisfaction, you can begin to plan for them with the same intentionality as retirement savings or home maintenance. This mindset shift is not about spending more, but about spending differently—making room for what truly enriches life while maintaining financial discipline.

Experience Consumption as a Financial Signal

Every dollar spent tells a story—not just about personal preferences, but about broader economic conditions. When large numbers of people begin booking more weekend getaways, upgrading dining experiences, or signing up for wellness workshops, these behaviors often precede or reflect shifts in the investment cycle. In fact, experience spending can act as an early warning system, offering clues about consumer confidence, income stability, and market sentiment.

Consider concert ticket sales. When major tours sell out within minutes, it’s not just a sign of fan enthusiasm—it often indicates that disposable income is available and people feel secure enough to spend it. Similarly, rising enrollment in fitness retreats or cooking classes may signal both a cultural focus on self-improvement and the presence of discretionary funds. On the flip side, when families start canceling trips or opting for free local events, it could point to tightening budgets or growing economic uncertainty.

For the financially aware individual, tracking personal experience spending can provide valuable insights. Are you spending more on dining out this quarter than last? Has your travel budget increased? These patterns, when reviewed over time, can reveal whether you’re responding to real income growth or simply riding a wave of optimism. By treating your own spending as data, you gain a clearer picture of your financial health and your sensitivity to economic shifts.

This awareness becomes especially useful during transitional phases of the investment cycle. For example, during periods of low interest rates and rising asset values, it’s easy to feel wealthier—even if income hasn’t changed. This “wealth effect” often leads to increased experience spending. But when markets begin to cool, those same spending habits can become unsustainable. Recognizing the link between your personal choices and macroeconomic trends allows you to adjust before financial pressure builds. In this way, experience consumption isn’t just a lifestyle choice—it’s a diagnostic tool.

Mapping the Investment Cycle Through Spending Habits

The investment cycle consists of four key phases: expansion, peak, contraction, and recovery. Each phase influences consumer behavior in predictable ways, and experience spending often mirrors these changes with remarkable clarity. During the expansion phase, employment is stable, wages may be rising, and confidence is high. This is when people feel comfortable booking international trips, attending festivals, or investing in personal development courses. The mood is optimistic, and spending on experiences grows steadily.

As the cycle reaches its peak, spending often accelerates. There’s a sense that good times will continue indefinitely. Families might upgrade from domestic vacations to luxury resorts. Dining out becomes more frequent. But this phase also carries risk. If spending is fueled by credit rather than income, it becomes vulnerable to reversal. The peak is not always obvious in real time, but looking back, many realize they spent most freely just before economic conditions began to tighten.

When contraction sets in—marked by job uncertainty, falling asset prices, or rising inflation—experience spending doesn’t disappear; it adapts. International travel may give way to road trips. Fine dining is replaced by home-cooked meals with friends. Yet people still seek connection and renewal. The difference is in the form: experiences become more local, more affordable, and more focused on shared moments rather than status. This shift isn’t failure—it’s resilience. It shows that enjoyment can be decoupled from high cost, and that meaning doesn’t require extravagance.

During recovery, spending begins to rise again, but often with greater caution. People may take shorter trips or book refundable options. There’s a renewed focus on value—getting the most emotional return for each dollar spent. This phase teaches important lessons about flexibility and intentionality. By observing how your own habits change across these cycles, you develop a deeper understanding of your financial behavior. You learn what truly matters and what can be adjusted. Over time, this awareness helps you spend with confidence, not compulsion.

Balancing Enjoyment and Discipline

There is no virtue in denying yourself joy. A life focused solely on saving and investing, with no room for pleasure, is not sustainable for most people. The goal is not austerity, but balance—finding a way to enjoy meaningful experiences without jeopardizing financial security. This requires planning, not deprivation. It means making space for what brings fulfillment while respecting the need for stability.

One effective approach is the use of sinking funds—dedicated savings pools for specific future expenses. Instead of charging a family vacation to a credit card, you can set aside a fixed amount each month in a separate account. Over time, the cost is spread out, and the trip is paid for in full when it happens. This method removes financial stress and turns what might feel like an impulse into a planned achievement. The same principle applies to concert tickets, dining experiences, or weekend workshops.

Another strategy is seasonal allocation. Rather than spreading experience spending evenly throughout the year, you can align it with income patterns. For example, if you receive a tax refund or annual bonus, you might allocate a portion to experiences during the spring or summer months. This allows for richer, more memorable moments without disrupting regular budgeting. It also creates natural boundaries—once the allocated amount is spent, you pause until the next cycle.

The key is intentionality. Impulse-driven spending often leads to regret, especially when bills arrive later. But when you plan for experiences in advance, they become part of your financial roadmap. You’re not spending recklessly—you’re investing in well-being. This shift in perspective transforms the emotional weight of spending. Instead of guilt or anxiety, you feel clarity and satisfaction. Over time, this builds a healthier relationship with money—one that supports both present joy and future security.

Risk Control: When Fun Meets Financial Prudence

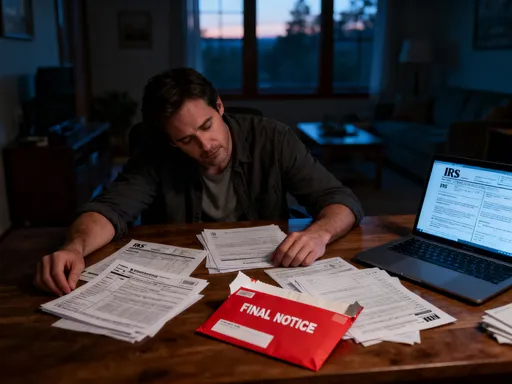

Every financial decision carries risk, and experience spending is no exception. The danger isn’t in enjoying life—it’s in allowing enjoyment to override judgment, especially during volatile economic periods. One of the most common mistakes is financing discretionary experiences with debt during market peaks. When stock values are high and confidence is strong, it’s easy to feel invincible. But when the cycle turns, those same debts can become burdens.

For example, charging a $3,000 vacation to a credit card during a market downturn—when emergency funds may already be strained—can lead to long-term financial strain. High-interest debt accumulates, and the pressure to repay can limit future flexibility. This is not responsible risk management. True financial resilience means protecting your ability to adapt, not maximizing short-term pleasure at the cost of long-term stability.

To avoid this, it’s essential to maintain liquidity. This means keeping enough cash or easily accessible funds to cover unexpected expenses without relying on credit. A general guideline is to have three to six months’ worth of essential expenses saved in a separate emergency fund. This buffer allows you to handle job loss, medical issues, or home repairs without derailing your financial plan.

Additionally, it’s important to guard against lifestyle inflation. As income increases, it’s natural to want to spend more. But if every raise leads to bigger vacations or fancier dinners, you may end up living paycheck to paycheck despite earning more. The solution is to increase savings and investments at the same rate—or faster—than spending. This ensures that financial progress translates into real security, not just visible consumption.

By applying these principles, you can enjoy experiences without compromising your financial foundation. The goal is not to eliminate fun, but to ensure it doesn’t come at the expense of peace of mind. When your spending aligns with your actual financial position—not just your current mood—you gain control. And control is the cornerstone of long-term financial health.

Practical Tools for Smarter Experience Investing

Good intentions need structure to succeed. Without practical tools, even the best financial mindset can falter when faced with a tempting offer or a spontaneous invitation. That’s why it’s important to implement systems that make smart spending easier and more consistent. These tools are not about restriction—they’re about empowerment, helping you make choices that reflect both your values and your financial reality.

One effective tool is the experience budgeting calendar. This is a simple schedule that maps out planned experiences for the year—birthdays, anniversaries, vacations, concerts—along with their estimated costs. By visualizing these expenses in advance, you can adjust your monthly savings to meet them. This prevents last-minute scrambling and reduces the temptation to use credit. It also allows you to prioritize what matters most. If a family reunion trip is important, you can plan for it early, knowing it will require trade-offs elsewhere.

Another useful method is a value scoring system. Before committing to an experience, ask yourself: How meaningful is this? How long will the memory last? How much stress will it relieve? Assign a score from 1 to 10 in each category. Then, divide by the total cost to get a “value per dollar” ratio. This isn’t about cheapness—it’s about maximizing emotional return. A low-cost picnic in the park with children might score higher than an expensive dinner out, simply because the connection and joy are greater.

Timing strategies can also enhance financial alignment. For example, booking travel during off-peak seasons often reduces costs by 30% or more. Similarly, buying concert tickets as soon as they’re released—rather than waiting for resale markets—can save hundreds. These choices aren’t about deprivation; they’re about intelligence. They allow you to enjoy more, for less, while staying within your financial boundaries.

Finally, consider linking experience spending to financial milestones. For instance, you might reward yourself with a weekend getaway after paying off a credit card or reaching a savings goal. This creates positive reinforcement, making discipline feel rewarding rather than restrictive. Over time, these tools become habits, embedding financial awareness into everyday life.

Building a Sustainable Financial Mindset

True financial well-being goes beyond numbers. It includes peace of mind, freedom from constant worry, and the ability to enjoy life without guilt. When you integrate experience spending into a disciplined financial strategy, you create a more complete and sustainable approach to money. You stop seeing budgeting and enjoyment as opposites, and begin to view them as partners in a balanced life.

This mindset shift is powerful. It allows you to spend on what matters—family, connection, personal growth—without fear. At the same time, it keeps you grounded in reality, protecting you from impulsive decisions that could derail long-term goals. You become more aware of economic cycles, more intentional in your choices, and more resilient in the face of change.

Over time, this approach builds confidence. You learn that you don’t have to choose between living well and saving wisely. You can do both. You can take that trip, attend that workshop, host that dinner—because you’ve planned for it, saved for it, and earned it. And when economic conditions shift, you’re not caught off guard. You adapt, recalibrate, and continue moving forward.

Ultimately, money is a tool—not just for accumulation, but for living. By treating experiences as part of your financial strategy, you align your spending with your values. You invest in moments that enrich your life, strengthen your relationships, and support your well-being. And in doing so, you build not just wealth, but a life of meaning, balance, and lasting satisfaction.