What I Learned About Money When My Career Hit Pause

When my career suddenly stalled, I panicked—bills didn’t stop, but my income did. That’s when I realized timing isn’t just about resumes; it’s about finances too. I had to rethink everything: how to protect what I had, where to find stability, and when to take smart risks. This is the honest breakdown of how I navigated the gap—not with perfect answers, but with real moves that actually worked. What began as a period of uncertainty turned into one of the most transformative financial lessons of my life. I learned that financial security isn’t built in crisis, but in the quiet moments of preparation long before trouble arrives.

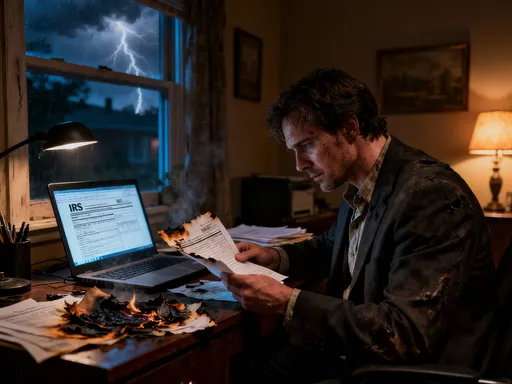

The Moment Everything Stopped

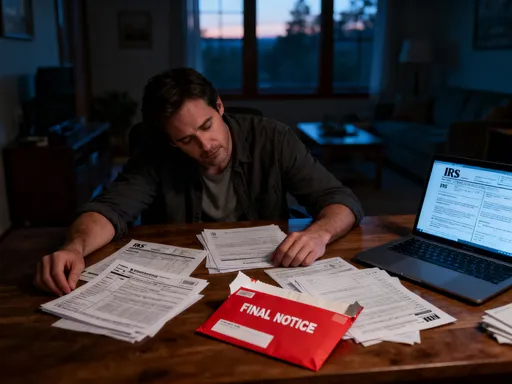

The call came on a Tuesday morning. No dramatic warning, no performance review—just a brief message: the company was restructuring, and my role was being eliminated. At first, I felt disbelief. I had been diligent, reliable, and committed. But none of that mattered in the face of industry-wide contraction. Within days, my access to email was cut, my desk cleared, and the rhythm of my professional life shattered. The emotional impact came later. The immediate crisis was financial. Rent was due in 12 days. My car payment, student loans, health insurance—all remained unchanged. The world kept moving, but my income had vanished.

This was the first time I truly understood the fragility of financial stability when it’s tied solely to employment. I had always assumed that as long as I worked hard, money would follow. But in that moment, I saw the flaw in that thinking. Being employed does not automatically mean being financially resilient. Resilience requires planning, buffers, and systems that function independently of a paycheck. Without an emergency fund, every decision became urgent and high-stakes. Should I dip into retirement savings? Could I sell investments at a loss? How long could I stretch my remaining cash? These weren’t hypotheticals—they were daily calculations.

I began tracking every expense, no matter how small. A $4 coffee suddenly represented an entire day’s grocery budget under my new math. I contacted every creditor, explaining my situation and asking for temporary relief. Some offered deferments; others adjusted payment dates. But none could eliminate the underlying obligation. I realized that financial survival during a career pause isn’t just about cutting back—it’s about having options. And options come from preparation, not improvisation. The gap between losing a job and finding a new one is rarely measured in weeks on a calendar. Financially, it can stretch into months, even years, depending on how prepared you are.

This experience stripped away the illusion that job security equates to financial security. I had been successful by traditional measures—steady promotions, competitive salary, professional recognition—but I was unprepared for the simplest truth: income can stop at any time. The real test wasn’t my ability to find another job. It was whether my financial foundation could hold while I did. That distinction changed everything.

Why Timing Matters More Than You Think

Most people think of financial timing in terms of the stock market—buying low, selling high, catching trends. But the most critical timing in personal finance has nothing to do with Wall Street. It’s about life timing. The difference between having three months of expenses saved versus six can determine whether a career gap becomes a setback or a catastrophe. I learned that reacting after a job loss is already too late. The real advantage belongs to those who act during periods of stability, when emotions are calm and choices are deliberate.

Looking back, I saw clear warning signs I had ignored. There were quarters when my income spiked due to bonuses or overtime, but instead of saving the surplus, I upgraded my lifestyle. A newer car, a larger apartment, more frequent dining out—each decision felt justified at the time. I told myself I deserved it. But what I was really doing was increasing my monthly burn rate, making me more vulnerable to any disruption. When income stopped, those upgrades became liabilities. I wasn’t just maintaining a lifestyle; I was trapped by it.

Timing in personal finance is about alignment—aligning your savings rate with your risk exposure, your spending with your income stability, and your investments with your life stage. I had treated financial planning as a one-time task, something to revisit during tax season or after a raise. But real financial health requires continuous attention. Markets move in cycles, but so do careers. Industries evolve, companies downsize, and roles become obsolete. None of these changes happen in isolation. They affect income, expenses, and psychological well-being.

I began to view my financial life as a series of overlapping timelines. There was the short-term timeline—covering immediate bills and emergencies. The medium-term—preparing for known future expenses like medical costs or family needs. And the long-term—building wealth for retirement and legacy. Each requires different strategies, but all depend on good timing. The mistake I had made was focusing only on the long-term while neglecting the short-term. I had contributed to retirement accounts but ignored my emergency fund. I had researched index funds but never calculated how many months of expenses I could cover without income.

The power of timing lies in compounding—not just for investments, but for habits. Saving $200 a month when you’re employed may seem small, but over two years, it becomes $4,800 plus interest. That sum can cover rent, utilities, and groceries for several months during a career pause. The same principle applies to debt reduction. Paying off high-interest credit cards while employed reduces monthly obligations, creating breathing room when income drops. These actions don’t require extraordinary effort, but they do require consistent timing. The best financial moves are often invisible—quiet deposits, automatic transfers, routine budget reviews—that build resilience over time.

Building a Safety Net Before the Fall

I learned the hard way that a safety net is not something you build while falling. It’s constructed when you’re standing on solid ground, when income is steady and stress is low. After my job loss, I had to sell investments at a loss, cancel planned repairs on my car, and borrow from family. Each decision eroded my confidence and long-term stability. If I had acted earlier, I could have avoided many of these choices. A proper safety net isn’t about getting rich—it’s about staying solvent during unexpected gaps.

Today, I structure my financial safety net in three layers. The first is immediate cash—money kept in a high-yield savings account that’s easily accessible. This covers one to two months of essential expenses and acts as a buffer for sudden needs like car repairs or medical bills. The second layer is short-term reserves—enough to cover three to six months of living costs, held in low-risk instruments like money market funds or short-term CDs. This is the core of emergency preparedness, designed to sustain me through a job loss or career transition. The third layer is long-term growth—investments in diversified portfolios that build wealth over time but aren’t meant to be touched during short-term disruptions.

What changed my approach was understanding liquidity. I used to keep most of my savings in retirement accounts or long-term investments. While those are important, they’re not accessible without penalties or market risk. During my career pause, I needed cash now, not in 20 years. I couldn’t wait for a 401(k) loan or a market rebound. I needed funds I could access within days. That’s why I now prioritize liquidity in my safety net. High-yield savings accounts, while not glamorous, offer a rare combination of safety, accessibility, and modest growth. They are the financial equivalent of seatbelts—unnoticed until you need them, then invaluable.

Another critical step was calculating my monthly burn rate—the total amount of money I spend on essential needs each month. This includes housing, utilities, groceries, insurance, transportation, and minimum debt payments. Once I knew this number, I could set a clear savings target. Instead of saving “as much as possible,” I saved toward a specific goal: six months of burn rate. That number became my financial anchor. It didn’t guarantee I’d never face hardship, but it gave me a defined threshold for security.

Building this net wasn’t easy. It required trade-offs—delaying upgrades, skipping vacations, saying no to lifestyle inflation. But each sacrifice strengthened my foundation. I no longer view saving as deprivation. I see it as preparation. And preparation is power. When your safety net is strong, a career pause doesn’t have to mean financial freefall. It can become a period of reflection, recalibration, and even growth.

Smart Moves to Stretch Your Runway

When income stops, the focus shifts from growth to preservation. Every dollar must be evaluated for its necessity and efficiency. I began by auditing my spending, categorizing every expense as essential or non-essential. Streaming services, gym memberships, subscription boxes—these small recurring charges added up quickly. Canceling them freed up over $150 a month, which may seem minor but represented nearly two weeks of groceries under my new budget.

More impactful was restructuring my obligations. I contacted my credit card issuers and negotiated lower interest rates. For one card with a $5,000 balance and 19% APR, I secured a reduction to 12%. That single change saved me over $350 in interest over the next year. I also explored refinancing my auto loan, which lowered my monthly payment by $75. These weren’t windfalls, but they extended my financial runway—the amount of time I could survive without income.

I also paused discretionary investments. I didn’t sell my retirement accounts, but I temporarily stopped contributing to them. This allowed me to redirect that money toward immediate needs without touching my emergency fund. It was a short-term adjustment, not a long-term abandonment of my goals. Once income resumed, I reinstated my contributions and even increased them to make up for lost time.

At the same time, I explored flexible income streams. I had skills in writing and project management, so I began taking on freelance work through online platforms. The pay was lower than my full-time salary, but it was enough to cover my phone bill, internet, and some groceries. More importantly, it restored a sense of agency. I wasn’t just waiting for a job—I was creating income on my terms. I set boundaries: no more than 15 hours a week, no projects that required me to be available at all hours. This wasn’t about replacing my career; it was about maintaining momentum.

One of the most valuable lessons was that small, consistent earnings are often more sustainable than sporadic windfalls. A $200 freelance payment every two weeks provided more stability than a single $800 project every few months. Predictability matters. It allows you to plan, budget, and regain control. I also discovered that some skills could be monetized in unexpected ways—helping small businesses organize their calendars, creating templates for professionals, even offering resume reviews. These weren’t high-paying jobs, but they kept money flowing and my confidence growing.

Investing in the In-Between: Risk and Reality

Many people assume that investing stops during a career gap. The logic is simple: no income means no extra money to invest. But I realized that investment isn’t just about putting money into the market—it’s also about preserving capital and making strategic decisions under pressure. I chose not to panic-sell my existing investments, even when the market dipped. Instead, I maintained a balanced approach: keeping the majority of my portfolio in conservative assets like bonds and index funds, while allocating a small portion to long-term opportunities.

Market downturns, often feared as disasters, became moments of opportunity. When stock prices dropped due to broader economic concerns, I used a portion of my emergency fund—no more than 10%—to buy shares in stable companies with strong fundamentals. This wasn’t speculation. It was disciplined, research-based investing. I focused on businesses with low debt, consistent earnings, and competitive advantages. These weren’t get-rich-quick bets; they were long-term holds.

The key was timing with patience, not prediction. I didn’t try to time the market perfectly. I didn’t wait for the absolute bottom. Instead, I used dollar-cost averaging—buying small amounts regularly—to reduce risk. This approach removed emotion from the process and ensured I wasn’t making decisions based on fear or greed. Over time, those purchases gained value, helping offset some of the financial strain of the gap.

I also used the time to deepen my financial knowledge. I read books on behavioral finance, studied retirement planning, and reviewed my asset allocation. I attended free webinars and joined online communities focused on personal finance. This wasn’t just productive—it was empowering. I began to see my career pause not as a failure, but as a forced sabbatical that allowed me to rebuild my financial literacy.

Investing during uncertainty isn’t about chasing returns. It’s about maintaining discipline, avoiding emotional decisions, and staying aligned with long-term goals. The market will fluctuate. Careers will have gaps. But a clear strategy, grounded in reality, can carry you through.

Rebounding with Confidence, Not Desperation

Coming out of the career gap changed how I viewed job offers. I no longer prioritized salary alone. I evaluated roles based on financial sustainability—does the income cover my needs with room to save? Flexibility—can I maintain work-life balance and handle future disruptions? And growth potential—will this role help me build skills and stability over time? These criteria protected me from taking the first offer out of desperation, which often leads to burnout or another premature exit.

I also made rebuilding my emergency fund a top priority, even on a lower initial salary. I started small—$100 per paycheck—but remained consistent. Within a year, I had restored three months of coverage. This wasn’t just about money. It was about peace of mind. I no longer feared the next unexpected bill or economic shift.

The timing of my re-entry mattered. I didn’t rush back into full-time work immediately. I waited until I found a role that aligned with my values and financial goals. At the same time, I didn’t wait too long, which could have eroded my confidence and professional network. I found the sweet spot by staying engaged—networking, learning, and taking on small projects—while being patient for the right opportunity.

This phase wasn’t about catching up. It was about moving forward with better rules. I no longer equated self-worth with job title. I measured success by stability, resilience, and freedom. That shift in mindset made all the difference.

Lessons That Last Beyond the Gap

This experience reshaped my entire financial philosophy. I now treat career stability as temporary and financial independence as essential. I automate 20% of my income into savings and investments before I even see it in my account. I conduct quarterly budget stress tests—what if my income dropped by 30%? What if I faced a medical emergency? These exercises keep me prepared.

I also review my risk tolerance regularly—not just for investments, but for life disruptions. I ask myself: Do I have enough liquidity? Are my obligations manageable? Could I handle another pause? These questions keep me honest and proactive.

The career gap didn’t ruin me. It reset me. It taught me that the best financial decisions are often made in silence, long before a crisis hits. They’re the quiet deposits, the avoided upgrades, the ignored impulse buys. They’re invisible to others but powerful in practice.

Timing in money management isn’t about perfection. It’s about preparation. It’s about understanding that financial resilience isn’t built in a day, but in the daily choices we make when no one is watching. What felt like a setback became a masterclass in patience, discipline, and foresight. And for that, I am grateful.